Top Companies Buying Notes

Common Misconceptions About Note Buyers

A multitude of individuals grapple with misconceptions about the motivations and machinations of note buyers. One widespread notion suggests these companies are lurking in the shadows, poised to prey on sellers caught in dire straits. Yet, let’s not be too hasty! The truth is far more nuanced: esteemed note buyers genuinely aim to offer a fair market price for financial instruments, grounded in established valuation metrics that guide their practices. They serve as vital conduits—facilitating liquidity for sellers who find themselves in need of immediate cash instead of languishing through structured payments over time.

Moreover, another pervasive misunderstanding clouds the landscape: the assumption that all note buyers operate under a uniform banner. Ah, but this could not be further from reality! The world of note buying is vast and varied—a tapestry woven from diverse companies each boasting their own methods for evaluating and acquiring notes. Differences abound; some excel in funding capabilities while others shine in customer service philosophies or transaction efficiencies. For sellers seeking a satisfactory deal amidst this complexity, grasping these distinctions becomes an essential endeavor—one that can lead to brighter outcomes than they might have envisioned!

Debunking Myths in the Industry

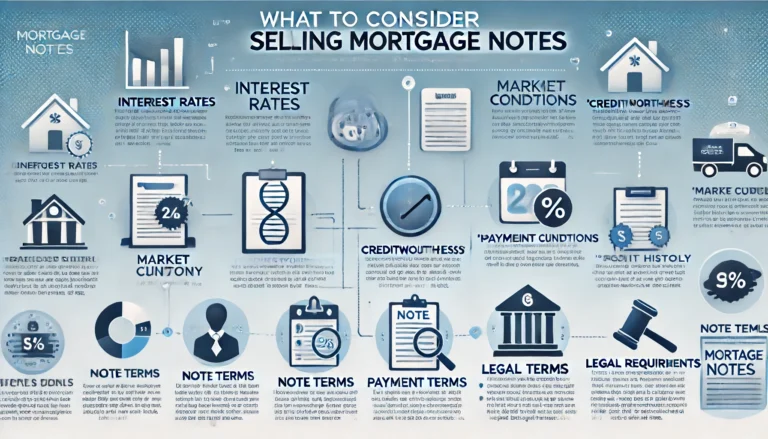

The world of note buying is shrouded in a haze of misconceptions, causing potential sellers to miss out on opportunities that could be truly lucrative. One pervasive myth? That only distressed notes are worthy of attention. In actuality, the landscape is far richer; performing and even partially performing notes can entice competitive offers from eager buyers. This revelation opens up a vast market, offering sellers a smorgasbord of options that might just align perfectly with their financial aspirations.

And then there’s the popular belief that diving into the note buying process is like navigating a labyrinth—complex and riddled with perilous pitfalls. Sure, there are legalities and financial intricacies at play, but many credible buyers have honed their processes to cut through the confusion and enhance safety for everyone involved. By partnering with established firms well-versed in the nuances of this industry, sellers can glide through the transaction confidently, all while securing terms that tip in their favor for those coveted notes!

| Myth | Reality | Opportunity |

|---|---|---|

| Only distressed notes are valuable. | Performing and partially performing notes can attract interest. | Access to a broader market of buyers. |

| The note buying process is too complex for sellers. | Experienced buyers streamline the process for safety and clarity. | Partnerships with established firms can ease transactions. |

| All notes are the same. | Notes vary significantly in value based on type and payment history. | Potential for customized offers based on note characteristics. |

| Sellers must accept the first offer they receive. | Negotiation is a normal part of the buying process. | Maximize profits through strategic discussions with buyers. |

Market Trends in Note Buying

In recent years, the note buying market has been a veritable rollercoaster ride, subjected to a whirlwind of economic influences. Picture this: rising interest rates have thrown open the doors to an arena buzzing with competition for buyers. Traditional investments now sparkle enticingly with higher returns, pulling attention away from notes like a moth to a flame. Meanwhile, alternative markets—think crowdfunding and peer-to-peer lending—have emerged as seductive new playgrounds for both individual investors and institutional giants alike, all on the hunt for fresh avenues of yield.

As demand for various types of notes swells like an unexpected tide, sellers are stepping up their game. They’re no longer operating in blissful ignorance; instead, they’ve become savvy strategists equipped with knowledge about valuations and market dynamics that would make any investor sit up straight. This newfound awareness has birthed sophisticated pricing structures that enable sellers to seize opportunities amidst fierce competition among note buyers. And let’s not overlook technology—it’s weaving its magic throughout this landscape! Streamlined processes are transforming how transactions unfold, ramping up efficiency and making access easier than ever for everyone caught in this intricate web of finance.

Analyzing Current Economic Factors

Economic conditions wield a profound influence over the realm of note buying, acting as both compass and catalyst. Picture this: interest rates are dancing to their own unpredictable tune, swaying the allure of notes as investment opportunities. When those rates soar high into the stratosphere, potential buyers often hesitate, wary of meager returns that fail to entice. Yet, flip the script—when rates descend like autumn leaves spiraling downwards—the market buzzes with renewed energy as investors hunt for yield in discounted notes like treasure hunters on a quest.

But wait! There’s more at play here than just interest rate fluctuations; broader economic indicators weave an intricate web that shapes buyer behavior. Inflation rates inching upward? Job growth sprouting—or stagnating? Consumer confidence rising or plummeting? All these elements stir the pot; stability in the economy can embolden buyers to leap forward while uncertainty sends them retreating into caution’s embrace.

And let’s not forget about real estate—oh no! The current state of property values adds another layer to this complex tapestry. As homes appreciate and prices climb higher, so too does the perceived value of secured notes, creating a fascinating interplay between tangible assets and financial instruments. For sellers aiming to squeeze every drop of value from their notes, keeping tabs on these multifaceted dynamics is nothing short of essential—a strategic lens through which they can navigate this ever-shifting landscape of note transactions.

Legal Considerations When Selling Notes

When diving into the realm of note sales, one must grapple with the intricate legal tapestries that weave through these transactions. Oh, the complexity! These frameworks—both state and federal—lay down a mosaic of regulations delineating what buyers and sellers can expect from one another. Sellers, take heed: familiarize yourself with the Uniform Commercial Code (UCC), a guiding beacon in navigating the choppy waters of notes and financial instruments. Adhering to these laws isn’t merely about ticking boxes; it’s about safeguarding your interests while ensuring that your deal stands firm against any courtroom scrutiny.

Now let’s talk contracts—the backbone of any serious note sale! A meticulously crafted contract is essential; it should shine a light on every detail—from payment arrangements to interest rates, even outlining what happens if things go sideways. Engaging with seasoned legal professionals who specialize in financial dealings is not just wise—it’s crucial for crafting provisions that are fair and fully encapsulate what you intend as a seller. This clarity? It goes beyond mere paperwork; it lays down a foundation for trust between all parties involved, minimizing potential disputes before they even have a chance to rear their heads!

Understanding Contracts and Regulations

Wading through the intricate maze of note sales is no small feat; it demands an astute grasp of contracts and regulations that swirl around like autumn leaves in a tempest. Each agreement—oh, how crucial it is!—must delineate the terms with laser precision: payment schedules, interest rates, and the swirling dance of rights and obligations for both parties involved. It’s a realm where attention to detail reigns supreme; one misplaced comma or ambiguous phrase can spiral into disputes that twist and turn, complicating what should be a straightforward transfer of ownership.

Sellers must also keep their eyes peeled for those pesky state-specific laws lurking in the shadows, ready to influence their selling journey. Compliance isn’t just encouraged—it’s essential if you want to dodge any nasty legal pitfalls down the line.

Now let’s not forget about regulatory frameworks—they often come packed with disclosure provisions. Sellers are obligated to unveil any critical details regarding these notes—a practice that fosters transparency and cultivates trust within this delicate transaction dance. Being well-versed in these labyrinthine regulations can empower sellers, enabling them to make savvy choices while deftly sidestepping potential risks inherent in the sale.

And here’s a nugget of wisdom: consulting seasoned legal professionals who specialize in note buying can bolster your understanding tenfold! They’re equipped to illuminate contractual obligations while safeguarding your interests throughout this complex process—essential allies as you navigate this compelling landscape.

- Understand the key components of a contract, including payment schedules and interest rates.

- Familiarize yourself with state-specific laws that may impact note sales.

- Ensure compliance with all applicable regulations to avoid legal issues.

- Be aware of disclosure provisions that require transparency in transactions.

- Consider seeking advice from legal professionals experienced in note sales.

- Keep detailed records of all agreements and communications to prevent disputes.

- Continuously educate yourself on changes in laws and regulations related to note sales.

How to Maximize Your Sale Price

To snag the absolute highest price for your notes, you need to dive deep into their worth—like, really deep. It’s not just about slapping a number on them; oh no! You’ve got to dissect interest rates, unravel those remaining payment terms, and scrutinize the borrower’s creditworthiness like a detective piecing together clues. Each of these factors can swing that final price dramatically!

Conducting a meticulous analysis of comparable sales is essential—it’s like peering through a crystal ball to see pricing trends unfold before your eyes. Adjust your expectations accordingly; don’t let wishful thinking lead you astray! And listen up: having all your documentation prepped and primed for potential buyers isn’t just handy—it’s crucial! This preparation can smooth out the negotiation bumps and bolster the perceived value of your notes.

But wait—there’s more! Effective marketing? Absolutely vital if you want to reel in those top-dollar buyers who are itching to hand over cash. Crafting an irresistible sales pitch that shines a spotlight on what makes your notes unique can be the golden ticket in this marketplace jungle. Think beyond traditional methods—tap into online marketplaces or niche-specific websites; widen that net! Plus, nurturing relationships with prospective buyers through networking isn’t just smart—it paves the way for smoother negotiations down the line, all while nudging that sale price higher than you ever imagined possible.

Tips for Effective Negotiation

Mastering the art of negotiation is a dance, an intricate waltz that demands you grasp not just your own desires and goals but also the rhythm of the marketplace. Before you stride into those pivotal discussions, take a moment to evaluate the worth of your notes—those little pieces of paper holding value beyond their ink. Dive deep into recent sales data; what are others fetching in this bustling bazaar? This intel becomes your armor, fortifying your stance with compelling reasons for that price tag hanging on your offering. With this knowledge swirling in your mind, confidence blooms like spring flowers, ready to fend off any lowball jabs thrown by eager buyers.

But wait! The symphony doesn’t end there; listening is where true magic happens. Tune in closely to what the buyer has to say—their worries, their aspirations—all woven into the fabric of negotiation. Mirroring their needs could unlock pathways to inventive solutions where both sides emerge victorious. Flexibility is key here; be willing to pivot or alter course based on their cues and feedback. Building rapport isn’t merely about small talk—it’s about crafting connections that can transform cold negotiations into warm collaborations, setting the stage for agreements that benefit everyone involved.

Future Outlook of the Note Buying Market

The note buying market stands on the brink of transformation, a metamorphosis fueled by leaps in technology and the evolving desires of investors. As financial tech weaves its way into the fabric of transaction methodologies, platforms dedicated to note sales are opening their doors wider than ever, welcoming a diverse array of participants. With transparency peeking through every corner and processes becoming slicker than a greased pig at county fair, an influx of eager buyers is likely—this burgeoning competition could spell good news for sellers.

But wait! The economy’s rollercoaster ride isn’t about to sit quietly on the sidelines. Economic shifts—those unpredictable tides that can raise or lower interest rates—will undeniably cast their influence over this sector’s future trends. As these fluctuations ripple through valuations like stones skipping across water, savvy investors will be compelled to recalibrate their tactics. And just when you think it’s all settled down? Boom! New opportunities will emerge as cutting-edge financing models and alternative investment paths come crashing onto the scene, potentially upending everything we thought we knew about navigating the world between note buyers and sellers alike.

Predictions and Emerging Opportunities

The note buying market is on the brink of a remarkable transformation, teetering towards significant growth as an ever-increasing number of investors awaken to the tantalizing potential returns that come with purchasing notes. Picture this: financial institutions and individual investors alike ramping up their involvement, all fueled by a low-interest-rate landscape that casts a spotlight on the alluring benefits of alternative investments. But wait—there’s more! The relentless march of technology and sophisticated data analysis tools promises to revolutionize valuation processes, making it not just easier but almost intuitive for buyers to gauge the real value lurking within those notes.

And what about emerging opportunities? They’re bubbling up from changing consumer behaviors and a surging demand for flexible financing options across diverse sectors. As businesses scramble for innovative funding solutions, savvy note buyers might stumble upon fresh avenues ripe for exploration—ways to source notes that align perfectly with these evolving needs. To top it off, the introduction of blockchain technology looms large, poised to inject transparency and security into transactions like never before; this could entice a whole new wave of players into the arena. All these elements coalesce into an exhilarating time ahead for note buying—a transformative period lies just around the corner!

Conclusion

The note buying market is in a constant state of flux, propelled by the ever-changing tides of economic conditions and the diverse interests of buyers. As a growing number of individuals and businesses delve into the benefits that come with purchasing notes, grasping the intricacies of this market becomes not just important—it’s vital.

Being well-versed in the myriad factors that sway note values and understanding potential legal ramifications can dramatically shape a seller’s journey. By keeping their fingers on the pulse of market trends and employing savvy negotiation tactics, sellers can enhance their results and maneuver through this intricate landscape with assuredness.