Review: Best Practices for Selling Mortgage Notes

Table Of Contents

Review: Best Practices For Selling Mortgage Notes | Review of Best Practices for Selling Mortgage Notes to Maximize Your Profit

Key Takeaways

- Insights into selling mortgage agreements and comprehending their nature.

- Effective strategies for the sale of mortgage agreements.

- Steps involved in the transaction of mortgage agreements.

- Acquiring mortgage agreements and what to consider.

- Overseeing personal mortgage agreements effectively.

Review: Best Practices For Selling Mortgage Notes | Understanding Mortgage Notes

Understanding mortgage notes is crucial for anyone considering a sale in the financial market. A mortgage note is a written agreement that outlines the terms and conditions of a loan secured by real property. This includes various types of loans such as fixed-rate mortgages, adjustable-rate mortgages, and home equity loans. The Review: Best Practices for Selling Mortgage Notes emphasizes the importance of properly preparing your mortgage note for sale to attract buyers, whether they are individual investors or institutions like the Mortgage Bankers Association. Knowledge about loan-to-value ratios, and the implications of loan modifications can also impact the valuation of your mortgage. Navigating the complexities of mortgage servicing is key in ensuring that the mortgage note remains a valuable asset. Understanding these elements can lead to more successful transactions in the realm of commercial mortgage and residential mortgage financing.

Review: Best Practices for Selling Mortgage Notes | Definition of Mortgage Notes

A mortgage note is a written promise to repay a specified loan amount, often accompanied by a loan agreement detailing the terms of the loan. In the realm of real estate finance, these notes can be utilized for seller financing, where the seller acts as the lender to the buyer. The mortgage note outlines critical details, such as the loan-to-value ratio and the payment schedule. The relationship between borrowers and lenders is formalized through these documents, making them essential in transactions involving loans. Understanding the intricacies of mortgage notes is key for anyone looking to engage in effective selling and investment strategies.

Reviewing best practices for selling mortgage notes involves recognizing potential risks, such as loan defaults or the presence of non-performing loans. Sellers must be proactive in assessing the financial health of borrowers and the underlying property. Engaging a financial advisor can provide insights into structuring favorable deals while highlighting the importance of clearly communicating terms to buyers. Proper documentation and transparency also play vital roles in fostering trust throughout the transaction. With a solid grasp of these fundamentals, sellers can navigate the complexities of the mortgage note market effectively.

Benefits of Mortgage Notes

Mortgage notes offer various benefits for both buyers and sellers involved in real estate transactions. For investors, purchasing mortgage notes provides a steady stream of income, especially when tied to rental properties. Lenders appreciate the flexibility these notes present, allowing for creative financing solutions beyond traditional bank loans. The truth in lending act (TILA) ensures transparency in these transactions, which can enhance buyer confidence. For sellers, understanding the Review: Best Practices for Selling Mortgage Notes helps position their notes favorably in the marketplace.

Financial analysis plays a crucial role in navigating the mortgage note landscape. Buyers must evaluate the creditworthiness of borrowers and consider the inherent financial risk associated with each note. Effective underwriting practices ensure buyers make informed decisions while securing favorable terms. By applying best practices, sellers can streamline their efforts and position their notes attractively against competitors. Engaging experienced brokerage services can further maximize returns while minimizing potential pitfalls in the selling process.

Best Practices for Selling Mortgage Notes

Successfully navigating the process of selling mortgage notes requires a deep understanding of various factors. A thorough review of your mortgage note can highlight its performance and financial stability, especially if it features a fixed interest rate. Sellers should be aware of potential buyers’ credit ratings and the implications of financial risks associated with mortgage note transactions. Engaging a knowledgeable broker can streamline offers and attract high-quality mortgage notes to potential buyers. Familiarity with real estate laws is crucial to ensure compliance and mitigate legal concerns. For those facing financial distress, utilizing financial derivatives may also help in optimizing the selling strategy. By focusing on these elements, sellers can foster a more effective and profitable mortgage note selling experience.

Preparing Your Mortgage Note for Sale

Preparing your mortgage note for sale requires careful consideration and organization. Understanding mortgage notes refers to both residential and commercial mortgage notes. Owners of individual mortgage notes or multiple mortgage notes must gather relevant documentation, including payment histories and borrower information. This information is crucial for potential buyers assessing the value of the mortgage note sale. A thorough review of these documents helps potential buyers make informed decisions about purchasing mortgage notes.

Approaching the sale of your mortgage notes can increase the chances of attracting interested buyers. Whether you are looking to sell non-performing mortgage notes or well-performing ones, clear presentation and transparency can enhance buyer confidence. A well-organized package that includes details of payment performance and terms is essential for facilitating a smooth transaction. By following best practices for selling mortgage notes, you can effectively market your assets and negotiate better terms in your mortgage note sales.

- Gather all relevant documentation, including payment histories and borrower information.

- Ensure all details are accurate and up-to-date to instill buyer confidence.

- Create a summary of the note’s performance, highlighting key metrics and history.

- Organize your documentation logically to facilitate easy review by potential buyers.

- Consider working with a mortgage note broker for expert guidance and networking opportunities.

- Be transparent about any potential risks associated with the mortgage note.

- Develop a concise marketing strategy to reach potential buyers effectively.

Pricing Strategies for Selling Mortgage Notes

Effective pricing strategies are crucial in the competitive mortgage note market. Understanding the value of your performing mortgage note is essential for attracting mortgage note buyers. Sellers should assess the specifics of their original mortgage note, including whether it is a residential or commercial mortgage note. Packaging mortgage notes can also enhance appeal, drawing attention from those seeking profitable mortgage notes. A thorough review of the market trends can help in determining a competitive price point that reflects the essence of your own mortgage note.

Setting the right price involves balancing what you believe your mortgage note is worth with what buyers are willing to pay. It’s important to consider factors such as interest rates, payment history, and the type of mortgage note being sold. Knowing how to navigate these elements effectively can help sellers create successful mortgage note transactions. By keeping mortgage note essentials in mind and staying updated on current market conditions, sellers can position themselves strategically within the realm of selling mortgage notes.

The Process of Selling Mortgage Notes

The process of selling mortgage notes involves understanding various factors that affect the value and appeal of the notes. A mortgage note defines the agreement between the borrower and lender, detailing the payment terms and interest rates. Review: Best Practices for Selling Mortgage Notes highlights the importance of pricing mortgage notes accurately, whether they are fixed-rate mortgage notes or adjustable-rate mortgage notes. Successful mortgage note transactions require an awareness of the note details, including whether they are institutional mortgage notes or private mortgage notes. Effective mortgage note negotiations can attract potential mortgage note investors, leading to favorable offers. Secured mortgage notes, such as a 15-year mortgage note, typically have a broader market appeal, making the selling process more streamlined for sellers.

Finding Buyers for Your Mortgage Note

A successful transaction begins by identifying the right buyers for your full mortgage note. Investors often seek large mortgage notes as they present substantial opportunities in the mortgage market. Understanding how mortgage note investments perform is crucial. Listing your mortgage property with reputable mortgage companies can significantly sway potential buyers. Those familiar with the nuances of the industry will appreciate the value of your original mortgage. Offering a competitive price and showcasing a well-maintained note can enhance your chances of attracting serious offers.

Finding buyers also involves utilizing various marketing strategies to source high-quality mortgage investments. Emphasizing your mortgage experience in communications can build trust with interested parties. Highlighting how your mortgage note performs over time reassures investors about the note’s reliability. It’s essential to understand that while a mortgage note can yield income, it can also die out if not managed well. Engaging with the mortgage community and participating in forums or listings can help you connect with potential buyers who are eager to invest in your mortgage note.

| Buyer Type | Investment Focus | Benefits of Selling |

|---|---|---|

| Individual Investors | Passive Income | Direct ownership and potential for steady cash flow |

| Real Estate Investment Trusts (REITs) | Diversified Mortgage Investments | Access to large capital and professional management |

| Institutional Investors | Large-Scale Notes | Higher returns and increased stability in diversified portfolios |

| Mortgage Companies | Wholesale Note Purchasing | Quick transactions and established buyer networks |

Navigating Legal Considerations in Selling

Legal considerations play a critical role in the sale of mortgage notes. Understanding the mortgage licensing act is essential for compliance, especially for sellers dealing with seller-financed notes and private mortgages. Sellers should review loan documents thoroughly to ensure all terms and conditions are clear. This process helps to mitigate mortgage-associated risks that could arise during the transaction, particularly for first-time mortgage note sellers. Having proper documentation in place enhances the credibility of the mortgage title, making the note more attractive to potential buyers.

Engaging a professional mortgage investor can be beneficial for navigating the complexities of the law surrounding mortgage transactions. These experts understand the nuances of property mortgages and can guide sellers through the legal framework while providing insights into market pricing strategies. Properly structuring the terms of the sale, including the handling of monthly mortgage payments and negotiating partial mortgage purchases, is vital in maintaining compliance with regulations. Sellers should also be aware of how traditional bank mortgages compare to their offerings to position their notes competitively in the market.

Buying Mortgage Notes

Purchasing mortgage notes requires due diligence and a clear understanding of the various factors involved. The first step is to conduct a comprehensive review of available notes, focusing on both performing and distressed notes. This analysis should include an assessment of the mortgage term, the borrower’s payment history, and any potential loan defaults. It is crucial to scrutinize the loan documentation, including loan documents that outline the terms of repayment and future mortgage payments. Knowledge of current mortgage delinquency rates can provide insight into market trends and risks. Real estate notes can offer lucrative opportunities, especially for investors looking for full mortgage purchases. Understanding the note sell options and the role of mortgage loan originators in the market can aid in making informed decisions. Adhering to the review: best practices for selling mortgage notes ensures a strategic approach to buying that maximizes potential rewards while mitigating risks.

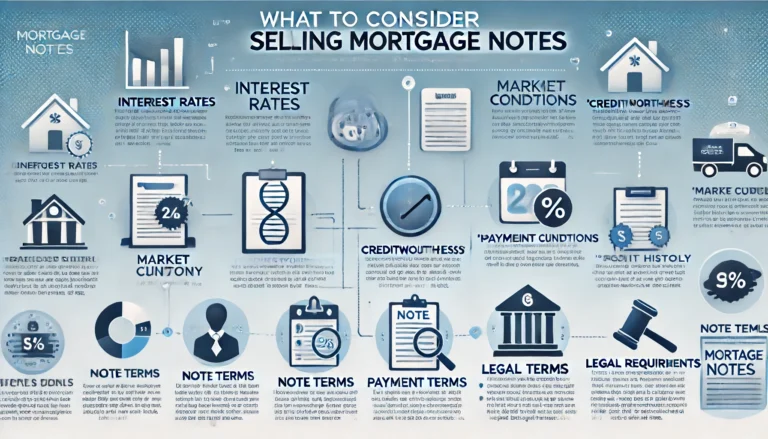

What to Look For When Buying Mortgage Notes

Evaluating the quality of the mortgage notes is crucial for note buyers. Understanding the terms of the note, payment history, and the creditworthiness of the borrower can significantly impact the investment’s potential return. It’s wise to look for quality notes that are backed by solid real estate assets. Engaging with reputable note brokers can help in identifying high-quality notes and navigating the complexities of the note sale process. A thorough review of the underlying property and borrower profile can ensure that you are investing in valuable notes that align with your financial goals.

Different notes come with varying levels of risk and reward. Buyers should be cautious about notes associated with distressed borrowers, as these may lead to payment defaults and decreased returns. On the other hand, stable borrowers typically present lower risk and can contribute to a steady cash flow. Understanding these factors becomes essential for note buyers aiming to make informed decisions. Engaging a qualified note brokerage can provide insights into the market value of the notes available and assist in selecting the right notes for your investment portfolio.

Risks and Rewards of Buying Mortgage Notes

Buying mortgage notes can offer attractive rewards, such as a consistent stream of income from loan payments. Investors can take advantage of note sale opportunities that present promising returns, particularly when the outstanding loan has a low loan-to-value ratio. Conducting thorough due diligence on the borrower creditworthiness is crucial for minimizing risks. Understanding the loan documents, including the terms detailed in the note purchase agreement, allows buyers to make informed decisions about potential investments.

Investors should also be aware of risks associated with purchasing mortgage notes, particularly the chance of encountering a 30-day mortgage delinquency. This situation can disrupt expected cash flow and lead to challenges in loan structuring if the borrower struggles to meet obligations. Similar notes may carry different levels of risk, highlighting the importance of examining each opportunity closely. Keeping in mind the strategies outlined in the Review: Best Practices for Selling Mortgage Notes can help buyers navigate potential pitfalls effectively.

Managing Your Own Mortgage Note

To navigate the complexities of managing your mortgage note effectively, a thorough understanding of the relevant financial documents is essential. Engaging in a borrower assessment can help gauge the reliability of the debtor, especially for high-yield notes or distressed notes. A solid grasp of the loan term and the nuances of the loan process allows for proactive management and potential loan restructuring. It is also wise to consider financing alternatives that may enhance the value of your investment. Establishing relationships with potential note buyers, including reputable note buyers, can facilitate the eventual sale of your note, aligning with the insights provided in the Review: Best Practices for Selling Mortgage Notes. Regular legal document review ensures compliance and protects your interests in the realm of real estate financing.

Strategies for Keeping Your Mortgage Note in Good Standing

Maintaining a mortgage note in good standing involves implementing sound financial practices throughout the note-buying process. Regularly communicating with borrowers can facilitate timely payments and help identify potential issues before they escalate. Establishing clear expectations concerning borrower rights and responsibilities is essential, as it promotes accountability. Keeping track of the outstanding loan balance and ensuring that terms meet the lending act guidelines are pivotal steps to minimize risks associated with borrower defaults.

For those engaged in private notes, understanding who the reliable borrowers are is crucial. Selling adjustable-rate notes may come with its challenges, particularly if you encounter low credit buyers. Monitoring borrower performance and being proactive about payment reminders can significantly reduce the chance of default. By adhering to these strategies, sellers can enhance the stability of note transactions while supporting borrowers in meeting their obligations, ultimately leading to successful outcomes in the review of best practices for selling mortgage notes.

- Regularly check in with borrowers to reinforce communication.

- Set up automatic reminders for payment dates.

- Keep a detailed record of all payments and outstanding balances.

- Provide educational resources to borrowers about managing their finances.

- Review and adjust loan terms if necessary to better fit the borrower’s situation.

- Conduct periodic assessments of borrower creditworthiness.

- Stay informed about changes in lending regulations that may affect your note.

Conclusion

Understanding the intricacies of mortgage notes is crucial for maximizing value and ensuring a smooth transaction. The Review: Best Practices for Selling Mortgage Notes emphasizes the importance of preparing your mortgage note thoroughly, which includes assessing the outstanding loan amount and exploring various note servicing options. Engaging with a reliable loan servicer can greatly enhance the chances of a successful sale. Pricing strategies must reflect the current market and the specific loan amount involved. By adhering to these best practices, sellers can navigate the complexities of the market more effectively and achieve favorable outcomes.

FAQS

What are the best practices to consider when selling first mortgage notes in the context of personal finance?

When selling first mortgage notes, it is essential to understand the mortgage notes offers available to you. Owning mortgage notes can be a lucrative aspect of personal finance, and you should know how to buy mortgage notes effectively. A strategic approach to mortgage notes can significantly impact the value of residential mortgage notes. For instance, accurately create mortgage notes and seek reputable mortgage notes buyers can enhance your investment. It is also vital to package mortgage notes properly and ensure the residential mortgage note adheres to market standards. Understanding the mortgage note details will help mitigate risks associated with listed notes, especially concerning loan note defaults. Engaging in loan sales, whether for real estate loans or private note sales, requires meticulous handling of loan documents, as these details ensure a smoother transaction, minimizing risks associated with commercial notes.

How can I effectively access mortgage notes and minimize risk when selling mortgage notes?

To effectively access mortgage notes, it’s crucial to understand the loan documents that provide insights into how each mortgage note performs. A well-informed approach to mortgage notes can sway your decision-making. Always seek mortgage notes with a solid payment history, as a mortgage note that performs well ensures a lower risk of default. Conversely, a mortgage note that dies or shows signs of trouble can lead to significant losses; therefore, knowing the details of the notes minimizes risk.

What approach should I take to assess mortgage notes before selling them effectively?

To effectively assess mortgage notes before selling, it’s crucial to understand how the mortgage note performs over time. A mortgage note isn’t just a financial instrument; it hinges on various factors such as the borrower’s reliability and the original loan documents. By evaluating these elements, you can access notes that are likely to yield a better return and sway potential buyers more favorably. It’s important to remember that a mortgage note does die if it’s not performing well, so thorough assessment and understanding are key to successful sales in the mortgage notes market.

What is the right approach to take when evaluating mortgage notes for sale?

When you’re looking to sell mortgage notes, the right approach involves thoroughly assessing the underlying value of the mortgage notes, including how well the mortgage performs and the condition of the loan documents. Additionally, consider whether the mortgage note hinges on specific conditions that could sway the mortgage note’s value, as this plays a critical role in ensuring a successful sale.

What is the best approach to take when dealing with mortgage notes to ensure a successful sale?

The best approach to take when dealing with mortgage notes involves thoroughly assessing the mortgage notes to understand their value and potential risks. It’s essential to review the loan documents, analyze the payment history, and consider factors like the borrower’s creditworthiness. Additionally, understanding how a mortgage note can sway the sale price is crucial, especially if it’s an active mortgage note or if the mortgage note dies. This comprehensive evaluation will help you make informed decisions and maximize the potential return on your mortgage notes.

What is the best approach for understanding the value of mortgage notes when considering a sale?

To effectively understand the value of mortgage notes, it’s crucial to analyze the underlying loan documents and evaluate the potential cash flow they generate. A thorough approach involves assessing the creditworthiness of the borrower and the interest rate environments that may sway the value of the mortgage note. Engaging with professionals who specialize in mortgage notes can also provide insights that enhance your understanding and market positioning.

What is the best approach for understanding how to sway mortgage note buyers during the sale process?

To effectively sway mortgage note buyers, your approach should include a thorough understanding of loan documents, the current market conditions, and the types of mortgage notes you are offering. Presenting detailed information about the mortgage notes and ensuring that all relevant loan documents are in order can significantly enhance buyer confidence and elevate interest in your mortgage notes.

What is the best approach to take for managing mortgage notes during the selling process?

The best approach to managing mortgage notes during the selling process is to thoroughly evaluate the loan documents and understand the underlying terms and conditions tied to the mortgage notes. This involves analyzing the payment history, current market conditions, and buyer preferences to position the mortgage notes effectively. By taking a strategic approach, sellers can enhance their chances of a successful transaction while maximizing their returns on the mortgagenotes.

What is the most effective approach for organizing loan documents to streamline the sale of mortgage notes?

The most effective approach for organizing loan documentsâthe key paperwork related to mortgage notesâis to ensure that all necessary documentation is readily accessible and clearly labeled. This will not only help in managing mortgage notes efficiently but also facilitate a smoother process when engaging with potential buyers.

What is the recommended approach to effectively market and promote mortgage notes that are available for sale?

The best approach to market mortgage notes involves understanding your target audience, utilizing multiple advertising platforms, and providing clear documentation to entice potential buyers, ensuring each aspect of the mortgage notes is highlighted effectively.