What is a note buyer?

Table Of Contents

Strategies for Maximizing Returns with Note Buyers

To maximize returns when working with note buyers, it is crucial to conduct thorough research and due diligence on potential buyers. This involves analyzing their track record, reputation, and financial stability in the market. By choosing reputable and financially sound note buyers, sellers can increase their chances of securing a favorable deal and maximizing the returns on their mortgage notes. Additionally, maintaining clear and open communication throughout the negotiation process is key to ensuring a successful transaction. Sellers should clearly articulate their expectations and be open to feedback and suggestions from the buyer to reach a mutually beneficial agreement. This collaborative approach can help maximize returns and lead to a smooth and efficient note sale process.

Leveraging Opportunities in the Note Selling Market

Leveraging opportunities in the note selling market can lead to significant financial gains for investors and individuals looking to liquidate their assets. Note buyers provide a viable option for those seeking to sell mortgage notes quickly and efficiently. By understanding the current market trends and conducting thorough research, sellers can optimize their returns and capitalize on the demand for mortgage notes in the financial industry.

Moreover, building strong relationships with reputable note buyers can open doors to new investment opportunities and potential collaborations in the real estate sector. By fostering trust and transparency in transactions, sellers can establish themselves as reliable partners in the note selling market. Leveraging these relationships can not only result in lucrative deals but also pave the way for future ventures and long-term success in the competitive world of note buying and selling.

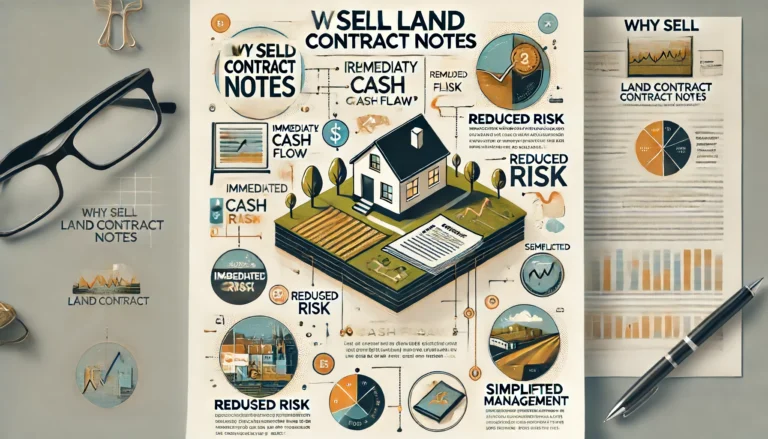

Risks Associated with Selling Mortgage Notes

Selling mortgage notes can come with its fair share of risks that sellers should be aware of. One significant risk is the potential for default by the borrower. If the borrower fails to make timely payments or defaults on the loan, the value of the mortgage note can decrease, leading to financial losses for the note seller. This risk is inherent in the mortgage note business, and sellers must be prepared to handle the consequences if such a situation arises.

Another risk associated with selling mortgage notes is the possibility of changes in the real estate market. Fluctuations in property values and market conditions can significantly impact the value of mortgage notes. A declining real estate market could result in a decrease in the value of the note, while a booming market may lead to increased competition and potentially lower returns for the seller. Staying informed about current market trends and seeking advice from experts can help sellers navigate these risks and make informed decisions when selling mortgage notes.

Understanding Potential Downsides of Working with Note Buyers

Working with note buyers can be a beneficial way to liquidate assets quickly and receive a lump sum of cash. However, there are potential downsides that sellers should be aware of before engaging in such transactions. One of the main drawbacks of working with note buyers is the possibility of receiving a lower purchase price than the face value of the note. Note buyers aim to make a profit, so they may offer sellers a discounted price in order to increase their own returns when they eventually collect on the note.

Another potential downside of working with note buyers is the risk of dealing with unscrupulous individuals or companies. It’s crucial for sellers to thoroughly vet potential buyers to ensure they are reputable and trustworthy. Working with a dishonest buyer can lead to legal issues, financial losses, and damage to one’s reputation. Due diligence and research are essential when considering selling mortgage notes to ensure a smooth and secure transaction.

Legal Considerations When Dealing with Note Buyers

When engaging with note buyers, it is crucial to be well-versed in the legal considerations that come into play. One key aspect to consider is the legal documentation involved in the sale of mortgage notes. Ensuring that all contracts and agreements are thorough and legally sound is essential to protect both the seller and the buyer in the transaction.

Moreover, it is vital to understand the laws and regulations governing note sales in the specific jurisdiction where the transaction is taking place. Compliance with these legal requirements is non-negotiable and failing to adhere to them can result in significant legal ramifications. Seeking guidance from legal professionals who specialize in real estate transactions can help navigate the complex legal landscape surrounding note sales.

Navigating Compliance and Regulatory Requirements in Note Sales

Navigating compliance and regulatory requirements in note sales is a crucial aspect that cannot be overlooked. It is essential for all parties involved in the transaction to adhere strictly to the legal framework governing the sale of mortgage notes. Failing to comply with these regulations can result in severe consequences, including legal ramifications and financial penalties. Therefore, it is imperative to thoroughly understand and follow all the applicable laws and guidelines to ensure a smooth and legally sound transaction.

Furthermore, staying updated on any changes or updates in the regulatory landscape is equally important. Regulations in the financial sector can undergo revisions periodically, and note buyers must stay informed to remain compliant. Engaging with legal professionals or consultants with expertise in the field of note sales can provide valuable insights and guidance on navigating the complex regulatory environment. By prioritizing compliance and staying abreast of regulatory requirements, note buyers can mitigate risks and foster a more secure and transparent selling process.

FAQS

What is a note buyer?

A note buyer is an individual or company that purchases mortgage notes, which are documents detailing the terms of a loan secured by real estate.

How do note buyers make money?

Note buyers make money by purchasing mortgage notes at a discount and then collecting the full amount owed by the borrower, thus earning a profit on the transaction.

What are the benefits of selling mortgage notes to note buyers?

Selling mortgage notes to note buyers can provide immediate cash flow, eliminate the risk of default, and offer the opportunity to invest in new ventures or properties.

Are there risks associated with selling mortgage notes to note buyers?

Yes, risks include potential loss of future income from the note, challenges in finding a reputable buyer, and the possibility of the buyer defaulting on the purchase agreement.

How can I protect myself legally when dealing with note buyers?

To protect yourself legally when dealing with note buyers, it is important to have a detailed purchase agreement, consult with a legal professional, and ensure compliance with all relevant laws and regulations.