Sell Owner Financed Notes

Legal Aspects of Selling Owner Financed Notes

Seller financing agreements—oh, they’re a labyrinth of legal implications! It’s absolutely vital to grasp the laws that govern these notes in your particular jurisdiction. We’re talking about compliance with consumer protection regulations and the whole spectrum of lending practices. Ignoring these guidelines? That could lead to some serious consequences, perhaps even punitive measures lurking around the corner. Documents must be meticulously crafted to embody every term agreed upon by both parties; clarity is key here! You need crystal-clear definitions surrounding interest rates, payment schedules, and what happens if someone defaults. These elements are indispensable for maintaining the transaction’s legal integrity.

But wait—what about reviewing the note’s enforceability? This step is equally crucial! If the original buyer falters in meeting their obligations, guess who has to swoop in and enforce those terms legally? That’s right—the seller. And this might mean delving into foreclosure or collection processes should a default occur. Enlisting a legal expert well-versed in real estate and note sales can shed light on complexities you might not have anticipated and help you sidestep potential pitfalls along this winding path. Ensuring all documentation is finalized and compliant serves as an essential shield for both seller’s and buyer’s interests throughout this intricate dance of transactions!

Importance of Proper Documentation

Proper documentation is absolutely vital in the intricate dance of selling owner-financed notes. It stands as the bedrock, a sturdy framework for validating and enforcing that all-important agreement. Think about it: detailed records act like a protective shield for both seller and buyer alike, meticulously laying out the terms of the note while delineating responsibilities regarding payments, interest rates, and any sneaky additional fees lurking in the shadows. When everything’s accurately documented, it streamlines this whole transaction saga—making rights and obligations crystal clear to everyone involved.

But beware! Incomplete or shoddy documentation can unleash chaos—disputes may arise like unexpected storms, threatening to derail what could have been a smooth ride. Buyers? They might hesitate at the prospect of snatching up notes without essential paperwork: promissory notes, amortization schedules—you name it—and those extra agreements tied to the sale are crucial too! Engaging legal professionals to prepare and review every document is not just smart; it’s essential for ensuring a seamless selling experience. And let’s not forget: well-organized documentation doesn’t merely serve its purpose—it enhances the allure of that note itself, boosting your chances of landing an irresistible deal!

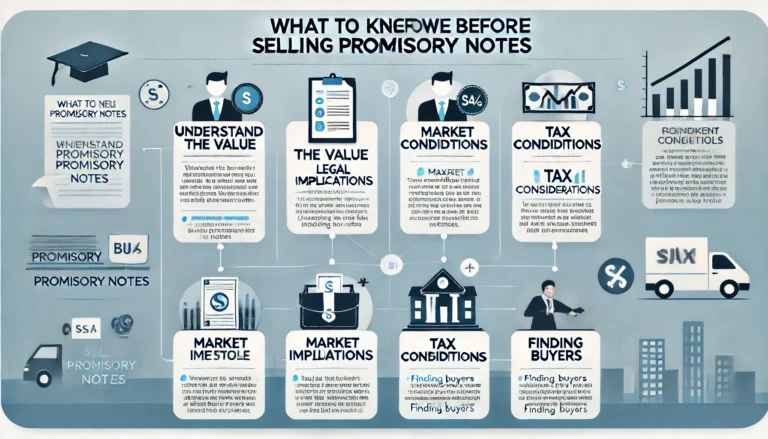

How to Determine the Value of Your Note

Figuring out the worth of your note is no simple task; it demands a deep dive into a myriad of critical elements. First off, let’s talk about interest rates—the lifeblood of any note’s value. A more generous interest rate? That tends to make the note sparkle in potential buyers’ eyes, boosting its desirability and market price. But wait, there’s more! The length of the repayment term also weaves its way into this intricate valuation dance. Shorter terms might promise quicker payouts, while those long-term commitments offer the steady drip-drip-drip of income over time.

And let’s not forget about the borrower—oh yes! Their creditworthiness looms large in this equation. A trustworthy borrower can wrap your investment in an aura of security that elevates its appeal even further.

Now, shift your gaze to broader market conditions—they’re like the weather affecting our little financial ecosystem. Scrutinizing current interest rates helps you gauge how well your note stands up against other opportunities vying for attention. And don’t overlook demand fluctuations for owner-financed notes; they can sway pricing dramatically! Keeping a pulse on economic trends becomes crucial here.

Finally, why not tap into expertise? Consulting with seasoned appraisers or savvy financial advisors who know their way around the note-buying arena can be priceless—offering insights that sharpen your understanding and ensure you’re making choices grounded in knowledge when it’s time to sell that note of yours!

Assessing Market Conditions and Rates

Diving into the labyrinth of market conditions is absolutely crucial when it comes to pinning down the true value of an owner-financed note. A medley of factors—think prevailing interest rates, the economic climate swirling around us, and those ever-shifting regional housing trends—contributes significantly to how attractive that note might be to potential buyers. Imagine a tighter market: it often whispers tales of heightened demand for notes, which could very well inflate their value like a balloon on a breezy day. On the flip side, picture a saturated market bursting at its seams with options galore; here, prices may just tumble like leaves in autumn.

But wait! There’s more than meets the eye. Staying attuned to the broader financial landscape? Absolutely imperative! Government policies morphing overnight, fiscal measures taking unexpected turns, or even investor sentiment doing its own dance can all sway buyer behavior and shift market rates like tectonic plates underfoot. By keeping a vigilant watch over these dynamics—a keen eye here and an ear there—sellers position themselves to make savvy decisions that resonate with current market expectations. This proactive approach not only sharpens their understanding but ultimately paves the way for a selling experience that’s as advantageous as it gets. In this intricate web of elements lies clarity about that note’s worth and opportunities for strategic positioning waiting to be seized!

| Market Condition | Description | Potential Impact on Note Value |

|---|---|---|

| Tight Market | High demand for limited owner-financed notes. | Increased value and selling price of notes. |

| Saturated Market | Abundance of options leading to increased competition. | Decreased value and selling price of notes. |

| Economic Climate | General economic conditions affecting buyer confidence. | Fluctuations in buyer demand and pricing strategies. |

| Interest Rates | Prevailing rates affecting the attractiveness of financing options. | Higher rates may diminish note appeal, lowering value. |

| Government Policies | Regulatory changes that impact real estate and financing. | Can introduce unpredictability, affecting buyer behavior. |

Working with Note Buyers

Navigating the maze of finding the right note buyer is absolutely vital for a transaction that doesn’t just succeed but thrives. Dive deep into research, peeling back layers on potential buyers—scrutinize their reputations, delve into their industry experience, and dissect the specific terms they bring to the table. A dependable buyer won’t leave you in the dark; they’ll illuminate their processes, fees, and timelines related to purchasing those owner-financed notes. Partnering with a company boasting a robust track record can be your golden ticket to ensure a seamless sale while deftly sidestepping future headaches.

But wait! Establishing rapport with your chosen buyer isn’t just beneficial—it’s essential. It can morph negotiations from mere transactions into collaborative ventures. When you articulate your expectations and financial aspirations clearly, it becomes easier to align interests like puzzle pieces fitting together perfectly. Remember, not all buyers are created equal; some offer varying levels of service that could enhance your selling journey tremendously—think support with documentation or insights into market trends that might otherwise remain elusive. Ultimately, making astute choices about which buyer aligns with your goals is pivotal in crafting an experience that doesn’t just meet but exceeds satisfaction thresholds in sales!

What to Look for in a Company

When it comes to the pivotal decision of selecting a company to sell your owner-financed notes, navigating this landscape is essential for both a seamless transaction and maximizing those hard-earned profits. You’ll want to keep an eye out for firms that boast a robust reputation within the industry—a beacon of reliability in what can often feel like murky waters. Dive into online reviews, sift through testimonials, and lean on recommendations from fellow sellers; these nuggets of insight are invaluable.

Don’t skip the crucial step of verifying their credentials—ensure they’re licensed in your state! It’s not just about checking boxes; you need a firm that truly grasps the nuances of owner-financed notes and has honed their expertise through experience with similar transactions.

Now, let’s talk customer service—the heartbeat of any good business relationship. A team that’s responsive and well-versed can transform what might be an overwhelming process into something clear-cut and manageable. Be sure to dig into the fees tied to your sale; clarity here is non-negotiable. Understanding all costs involved empowers you to make decisions grounded in knowledge rather than guesswork.

Finally, scout out companies willing to present offers that reflect fair market value for your note—this speaks volumes about their understanding of current market dynamics and interest rates. In this intricate dance between buyer and seller, finding that perfect match can spell success—or at least tilt the odds in your favor!

- Research the company’s history and track record in the industry.

- Verify the credentials and licensing requirements in your state.

- Assess the responsiveness and helpfulness of their customer service team.

- Inquire about the transparency and clarity of their fee structure.

- Compare multiple offers to gauge fair market pricing.

- Look for any additional services they may provide throughout the transaction.

- Evaluate their communication style to ensure it aligns with your expectations.

Common Misconceptions About Owner Financed Notes

There’s a widespread notion swirling around that owner financed notes are perilously risky investments. Detractors frequently spotlight the looming specter of buyer default as a major red flag. Sure, risks are lurking in the shadows, but they can be adeptly managed through thorough screening and meticulous research. By conducting proper due diligence, sellers gain insight into the financial health and creditworthiness of prospective buyers, paving the way for transactions that feel far more secure.

Then there’s this other pervasive myth: selling owner financed notes is some labyrinthine ordeal fraught with complexity. Many folks leap to the conclusion that navigating the intricate web of legal and financial nuances demands an expert’s touch. But hold on! With just a dash of preparation and access to solid resources, sellers can wade into this market brimming with confidence. A plethora of professionals and platforms stand ready to guide them through every twist and turn, transforming what could be an overwhelming process into something streamlined and accessible for those eager to make their notes work for them.

Debunking Myths Surrounding the Sale

Many aspiring sellers of owner-financed notes grapple with a web of misunderstandings that cloud the process. A particularly persistent myth suggests that selling a note means relinquishing all ownership—a misconception that can loom large in their minds. In truth, sellers often retain various rights depending on the specifics laid out in their sale agreements. This could even include potential residual income if crafted with care and foresight.

Then there’s the notion surrounding timing—a common pitfall for many. The belief that selling notes is an arduous, drawn-out affair stirs hesitation and doubt among potential sellers. Yet, one must consider how advancements in technology and streamlined procedures have revolutionized this landscape, paving the way for swifter transactions than ever before.

Another fallacy worth unpacking is the assumption that all note buyers operate on a level playing field—offering akin terms and expertise across the board—which leads some to neglect critical research into prospective buyers. It’s essential to grasp that not every company adheres to identical guidelines or market conditions; this disparity can spawn dramatically different offers for what seems like the same asset.

Furthermore, some sellers may wrongly conclude that hefty fees tied to brokers or intermediaries are simply par for the course—a necessary evil they must endure. However, it’s often possible to engage directly in negotiations, potentially unearthing more advantageous terms while trimming back costs significantly! Thus, delving into all available options becomes paramount before making any final decisions on how best to proceed.

Maximizing Your Profit When Selling

Navigating the intricate dance of negotiation can dramatically shape the profit you walk away with when selling owner-financed notes. Start by laying out your note’s particulars in a way that’s crystal clear—think payment history, terms, interest rates, and any other significant tidbits. Buyers tend to gravitate toward transparency; it fosters trust and sets a solid stage for effective negotiation. Arm yourself with compelling documentation to back up your asking price—that’s how you fortify your stance.

Dive deep into researching potential buyers—who are they? What does their reputation look like in this bustling marketplace? Engaging multiple buyers opens up a world of comparison, enabling you to gauge each one’s willingness to play ball. It pays off handsomely to assess their knack for accurately valuing such notes too! Targeting those who specialize specifically in owner-financed notes could offer a more customized approach that might just lead to sweeter deals. And remember: don’t shy away from negotiating aspects beyond just the price itself; being flexible on payment structures or timelines can unlock doors to extra profitability you didn’t even see coming!

Tips for Negotiating the Best Deal

When diving into the intricate world of negotiating owner-financed notes, grasping the true worth of your asset isn’t just important—it’s absolutely vital. Dive deep into research, sifting through a myriad of comparable notes that currently grace the market. This exploration will lay a robust groundwork for your asking price. Get cozy with industry standards and recent shifts that sway note values; knowledge is power, after all! The more informed you are, the stronger your stance in discussions becomes—like a fortress built on solid rock.

Now, let’s not forget about human connection—a rapport with potential buyers can be a game-changer in negotiations. Shift your mindset from viewing this as merely another transaction to cultivating long-lasting relationships. Approach conversations with an open heart and keen ears; listen actively to what buyers express—their concerns and desires could pave the way to terms that benefit both sides immensely. And yes, prepare yourself for some give-and-take: whether it’s tweaking down payments or adjusting interest rates slightly here and there, remain flexible without sacrificing the overall essence of your note’s value!

Conclusion

Diving into the intricate maze of selling owner-financed notes can dramatically influence not only timing but also profitability. Grasping the legal nuances, keeping a pulse on market dynamics, and debunking prevalent myths are absolutely crucial for making savvy decisions at every turn. Plus, collaborating with trustworthy note buyers can simplify transactions and potentially amplify your returns.

To truly maximize profit, one must embark on a journey of exhaustive research blended with shrewd negotiation tactics. Being thoroughly equipped can usher in more advantageous outcomes than you might expect. Tapping into the wisdom of industry insiders and utilizing comprehensive documentation lays down a robust groundwork for successfully unloading those notes. By taking these proactive measures, sellers position themselves to meet their financial aspirations while deftly minimizing risks along the way.