How much do mortgage notes sell for?

Table Of Contents

Pricing variations based on the note’s seasoning

Mortgage notes, like fine wine, tend to increase in value with age. Investors often find themselves willing to pay a premium for seasoned notes, which have a track record of consistent payments over an extended period. This history of on-time payments not only provides a sense of security for the buyer but also indicates the reliability of the borrower.

Conversely, newly originated notes, or notes with limited payment history, may be viewed with more skepticism in the market. These notes lack the established track record that seasoned notes offer, making them riskier investments. As a result, newer notes typically sell for lower prices compared to seasoned notes, as investors factor in the uncertainty associated with the borrower’s payment behavior.

Age of the mortgage note

The age of a mortgage note greatly impacts its sale value in the secondary market. Typically, newer notes tend to sell for a higher price compared to older notes. This is due to the fact that newer notes carry less risk for potential buyers as there is a longer period of time for the borrower to default on payments. On the other hand, older notes may have a history of missed payments or other financial issues, making them less desirable to investors.

Investors often prefer to purchase mortgage notes that are relatively new, as these notes are perceived as having more stable payment histories. This preference stems from the belief that a borrower who has consistently made payments for a longer period of time is more likely to continue doing so in the future. Therefore, mortgage notes that are younger and demonstrate a track record of timely payments are generally valued higher in the market.

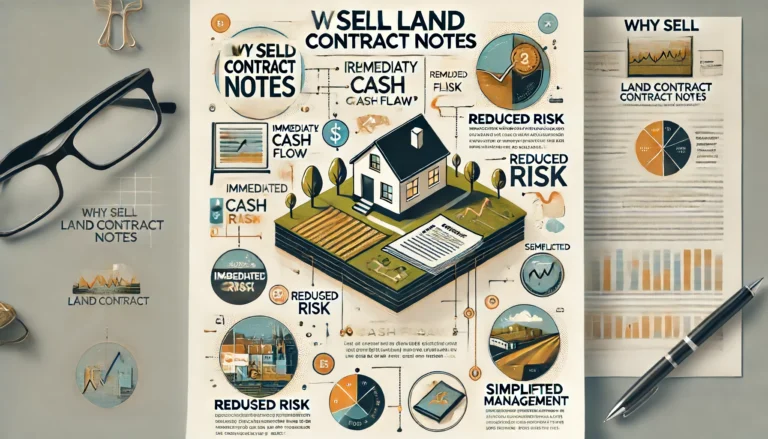

Influence of the current real estate market on note values

The current real estate market plays a significant role in determining the value of mortgage notes. When the real estate market is booming, the value of mortgage notes tends to increase due to the high demand for property investments. Conversely, during a downturn in the real estate market, the value of mortgage notes may decrease as the perceived risk of default rises.

Investors closely monitor the housing market trends to assess the potential risks and returns associated with purchasing mortgage notes. Positive trends, such as increasing property values and low foreclosure rates, can lead to higher note values, while negative trends may reduce the value of mortgage notes. Overall, the real estate market’s performance has a direct impact on the pricing and demand for mortgage notes in the secondary market.

Housing market trends

Housing market trends play a crucial role in determining the value of mortgage notes. Factors such as supply and demand, interest rates, and economic conditions greatly impact the real estate market, consequently affecting the pricing of mortgage notes. In a booming housing market, where property values are on the rise and demand is high, mortgage notes tend to sell for a premium due to the perceived lower risk associated with the investment.

Conversely, in a stagnant or declining housing market, mortgage note values may decrease as investors become more wary of default risk and the overall health of the real estate sector. Understanding these market trends is essential for buyers and sellers of mortgage notes to make informed decisions regarding pricing and investment strategies. By staying informed and monitoring the market closely, investors can position themselves to capitalize on opportunities and mitigate risks associated with owning mortgage notes.

The significance of the payment history on note pricing

The payment history of a mortgage note plays a crucial role in determining its pricing in the secondary market. Potential buyers closely examine the borrower’s track record of making timely payments as it directly impacts the perceived risk associated with the investment. Notes with a consistent history of on-time payments are typically valued higher due to the lower risk of default. Conversely, notes with a history of missed or late payments may be sold at a discounted rate to offset the increased risk for the buyer.

Lenders and investors consider the consistency of payments when evaluating mortgage notes for purchase. An uninterrupted payment history indicates a reliable borrower who is likely to continue fulfilling their obligation, making the note a more attractive investment. In contrast, irregularities or missed payments can raise concerns about the borrower’s financial stability and their ability to meet future payment obligations. Consequently, notes with a strong payment history are more likely to command a premium price in the market, reflecting the lower perceived risk for the buyer.

Consistency of payments

Consistency of payments is a crucial factor influencing the pricing of mortgage notes. Lenders prefer notes where the payment history demonstrates reliability and consistency. A note with a consistent payment history is considered less risky, leading to higher selling prices in the secondary market. On the other hand, notes with a history of late or missed payments may be less attractive to investors, resulting in a lower sales price.

Borrowers who consistently make on-time payments are more likely to honor the terms of the note until maturity. This predictability provides a level of stability for investors and mitigates the risk associated with default. Consequently, notes with a track record of consistent payments command a premium in the market compared to notes with a less reliable payment history.

FAQS

How is the pricing of mortgage notes determined?

The pricing of mortgage notes is influenced by factors such as the note’s seasoning, age, current real estate market conditions, payment history, and consistency of payments.

What is the significance of the age of a mortgage note in determining its selling price?

The age of a mortgage note can impact its selling price, with newer notes typically selling for higher prices compared to older notes.

How does the current real estate market affect the value of mortgage notes?

The current real estate market conditions play a significant role in determining the value of mortgage notes. Factors such as housing market trends can impact the selling price of mortgage notes.

Why is the payment history important when selling a mortgage note?

The payment history of a mortgage note is crucial in determining its selling price. Consistent and on-time payments can increase the value of the note.

How does the consistency of payments influence the pricing of mortgage notes?

Mortgage notes with a history of consistent payments are often more attractive to buyers, potentially leading to a higher selling price.